Show

To get a property was fascinating, particularly as you journey the newest cities and ultimately fall in love having property. But how do you really determine the budget? Setting realistic requirement, think about your private money, borrowing alternatives, additionally the total costs of shopping for.

Here’s what we’ll safety:

- Guess your earnings

- Assess your debt

- Familiarize yourself with your own month-to-month expenditures

- Check your credit rating

- Score pre-recognized to own home financing

- Realize about their home loan options

- Search initial can cost you

- Determine brand new budget for citizen will cost you

- Policy for changes

step 1. Guess your income

Finance companies normally ft their financial approval amount on the disgusting month-to-month money, which is your full settlement ahead of fees and other deductions. That it number will give you an understanding of how much money available for you monthly to fund all of your expenditures. The method that you assess your gross monthly income utilizes just how you are paid:

For folks who discover a yearly paycheck, split it from the several in order to estimate the terrible monthly money getting you to business. quick cash loan Breckenridge Such as for example, if your annual salary try $75,000 per year, the terrible month-to-month earnings would-be $6,250 ($75,100 separated because of the twelve).

If you’re paid down each hour, then it’s beneficial to start by the common number of circumstances you functions each week because your plan can differ. You may then proliferate you to definitely matter by your each hour rates so you’re able to score an estimate of the gross income each week. Just multiply you to definitely number because of the number of days your performs each year so you’re able to estimate your own gross yearly income. Ultimately, just take you to definitely amount and you will split they of the twelve so you can imagine the disgusting monthly money.

Including, let’s say you will be making $15 by the hour, you work on average thirty-five times per week, while always get 2 weeks travel. Contained in this condition, the estimated terrible per week earnings try $525, plus disgusting annual money is actually $26,250 ($525 multiplied by fifty months), along with your disgusting monthly earnings is $dos, ($twenty six,250 separated from the several).

When you yourself have unpredictable earnings – particularly, you will be paid down for the fee, receive bonuses or sporadically really works overtime – quoting your revenue can be somewhat alot more challenging. It is useful to check an old background for this version of money plus an economic or industry frame of mind.

When you expose the possibilities of the bonuses and you may profits to have the following season, this type of quantity will be used in the projected disgusting month-to-month earnings. Add up the excess quantities of income you have made from the year, and separate they because of the twelve. Add which add up to their disgusting monthly money.

dos. Assess your debt

Along with your income, loan providers also want to know your financial obligation, such handmade cards, vehicle repayments, medical costs, student loans, otherwise taxation liens. They will use the rule when being qualified mortgage applicants. This laws claims one a household is always to spend a total of 28 percent of its terrible monthly money into total housing costs no more than thirty-six per cent towards the overall personal debt services, and homes and other personal debt such car and truck loans, centered on Investopedia.

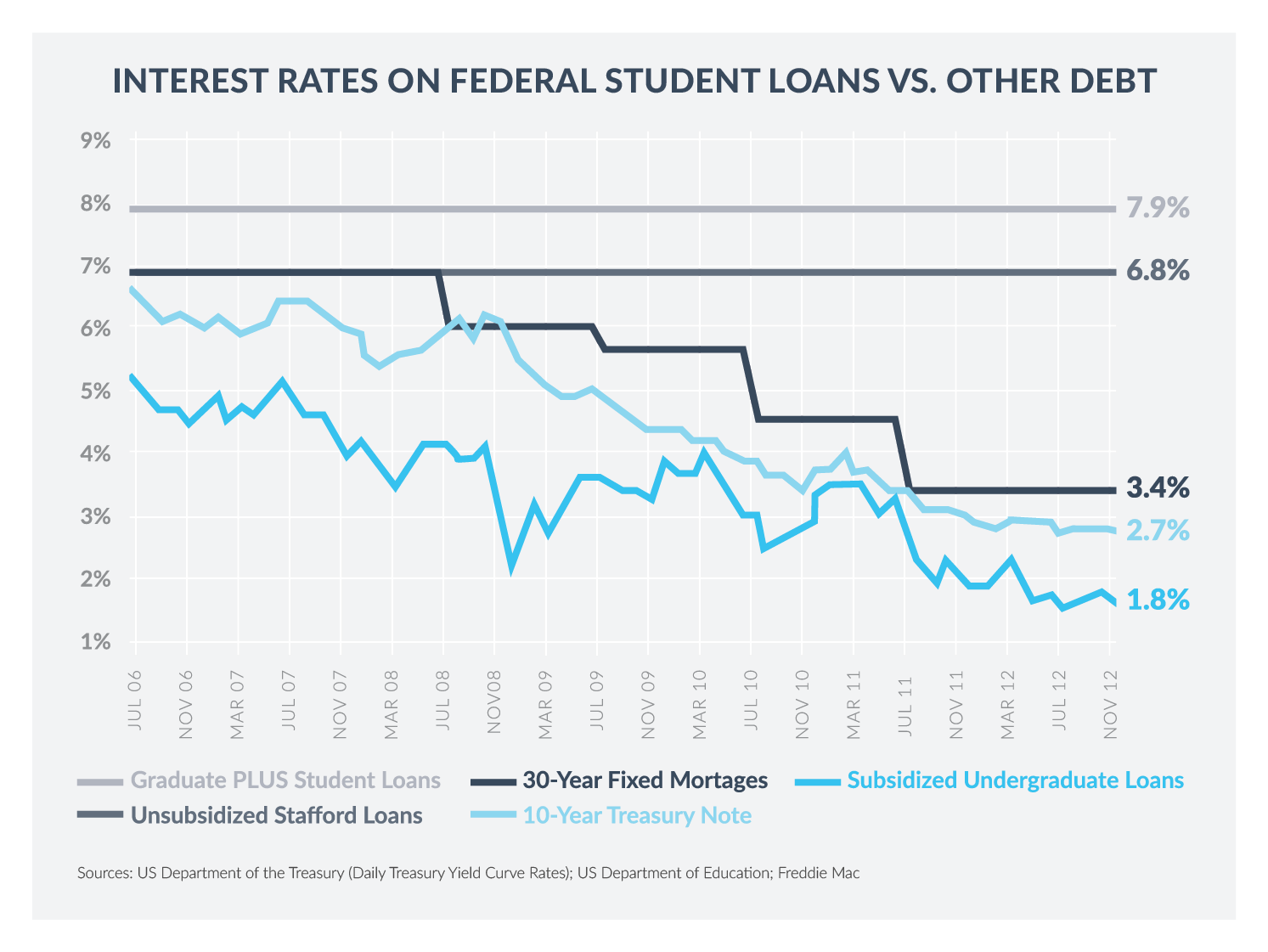

The brand new twenty eight per cent piece is known as brand new front-stop proportion and you will comes with the fresh five components of the financial, also known as PITI: dominating, attention, property taxation, and you may homeowner’s insurance policies. If your down-payment is actually lower than 20%, you are able to always have to pay personal mortgage advanced (PMI), which you will include regarding the twenty-eight %. When your residence is element of a good homeowner’s association (HOA) that really needs owners to blow dues, and/or family demands supplemental insurance (particularly ton insurance), were those costs as well.